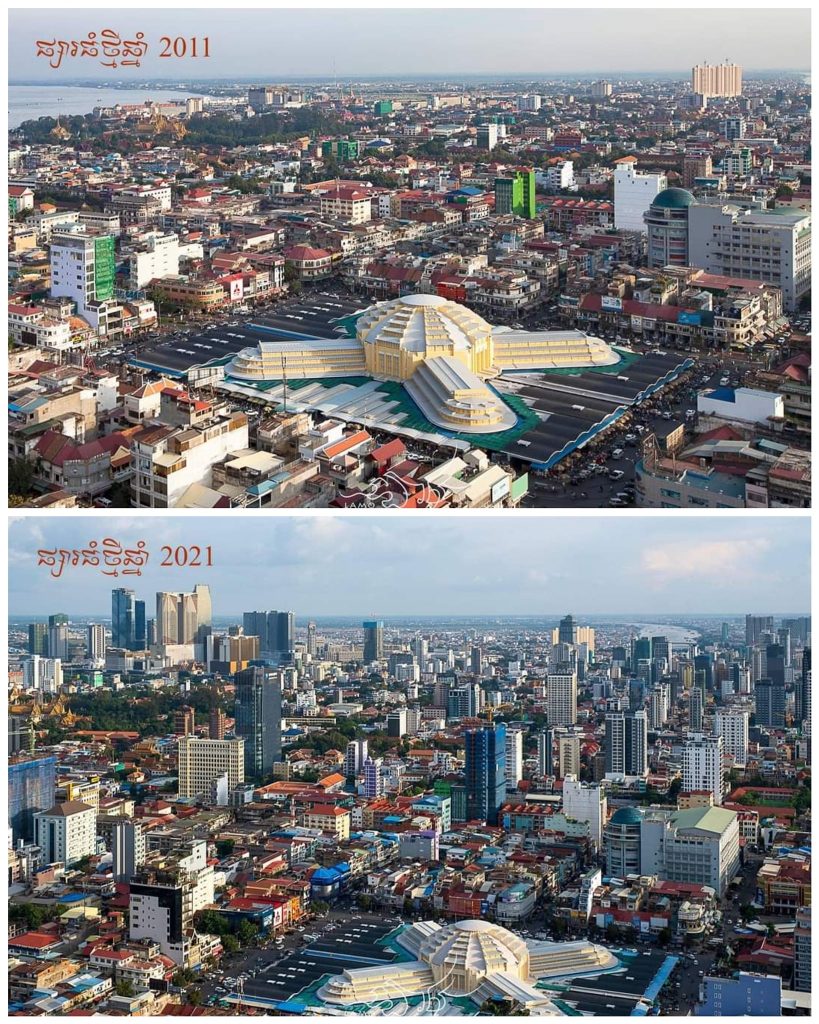

In my recent post about leading a walking tour through Phnom Penh I mention the rapid growth of high-rise buildings in the city. Specifically, that there were only three skyscrapers (two completed, one in progress) when I left in 2009 and that a decade later the Phnom Penh skyline was filled with high-rises when I returned in 2019.

In 2022, the Ministry of Land Management, Urban Planning, and Construction reported that there were more than 2,500 high-rise projects in Cambodia from 2000 to 2022. This was broken down as follows…

- 1,423 buildings between 5 to 9 floors

- 699 buildings between 10 to 19 floors

- 233 buildings between 20 to 29 floors

- 129 buildings between 30 to 39 floors

- 50 buildings over 40 floors

Historically, high rises were built in areas with high population and limited/expensive land. New York city in the United States being the classic example. Phnom Penh does have rising population density and rising property value, but the number of high-rises is remarkable. Most of these high-rise buildings are sparsely populated with rents that are far beyond the means of most Cambodians.

So what’s driving this construction?

One reason is that the construction is being driven by financial investment, not to meet need. This is hardly unique to Cambodia. It is one of the main reason that the United States is currently facing a housing affordability crisis and one of the main reasons that what was the world’s most valuable real estate company in 2018, Evergrande Group, is now facing bankruptcy.

When investors, not potential occupants, drive construction the market begins to prioritizes high-value properties like condos, high-rises, and malls over affordable housing. The problem is then that the real estate market becomes oversaturated with high-value property at the same time that there’s a shortage of affordable property.

Generally, we’ve observed four distinct groups of investors behind most of these projects.

- Foreign companies and investors who want to be in on what they hope will be Asia’s next construction boom. They are betting that Phnom Penh will be the next Kuala Lumpur, Ho Chi Minh, or Bangkok. This kind of speculative construction has vastly oversaturated the market for high-value real estate – not just in Cambodia but across the region – however there are signs that this bubble may be on the verge of bursting.

- Foreign companies and investors who are using loans on construction projects to pay off loans on previous construction projects. The corporate equivalent to paying off a credit card with a credit card. This practice is what ultimately bankrupted Evergrande after they left a string of ghost cities across China and other parts of Asia.

- Cambodian companies, investors, and tycoons who want to invest their savings securely and who see real estate as the safest investment. Investments include more reasonable construction projects like mid-rises, open air markets, and hotels…but also high-rises, luxury malls, and mansions.

- International organized crime, particularly Chinese mafia, who used construction to launder money from illegal activities. They contract front companies they own to build high-value properties that cut as many corners as possible while appearing as lavish as possible in order to maximize funds that can be laundered. This is most evident in Sihanoukville but has also occurred in Phnom Penh and across the country.

Beyond housing affordability, this construction boom has a broader impact on the vulnerable rural communities where we do most of our work.

All of the concrete for this construction is made with sand dredged from the Mekong, which has dramatically altered the river’s flow disrupting natural fisheries and traditional rice farming. One of my first posts on this blog was on sand dredging and that practice continues, but the sand is no longer being exported and is instead being used for the construction boom.

The concentration of high-value urban development also pulls resources, like ground water, away from rural communities. In some cases, even the soil used for high-rise foundations was bought from indebted farmers and trucked into the city to fill in the uneven land. Trash, electricity, and sewage present similar issues.

Wow, I don’t even know what to say to all of that…it’s sad. It’s also amazing to see all of the changes in such a short amount of time. Taking away from the those who are already struggling…that has got to feel discouraging, plus, I feel angry!! A friend in Sedona recently told me that there is a housing shortage in Sedona, for those who work there. The home rentals are now Air BnB’s. The rental costs, if you can find a rental have sky-rocketed, even higher than what they were back when I lived there. If there is no cost of living increase to go with the sky-rocketing costs of everything else. I have no answers, only hope and prayers for positive, healthy, peaceful changes for ALL on our planet.

Greed! A universal problem. So sad!